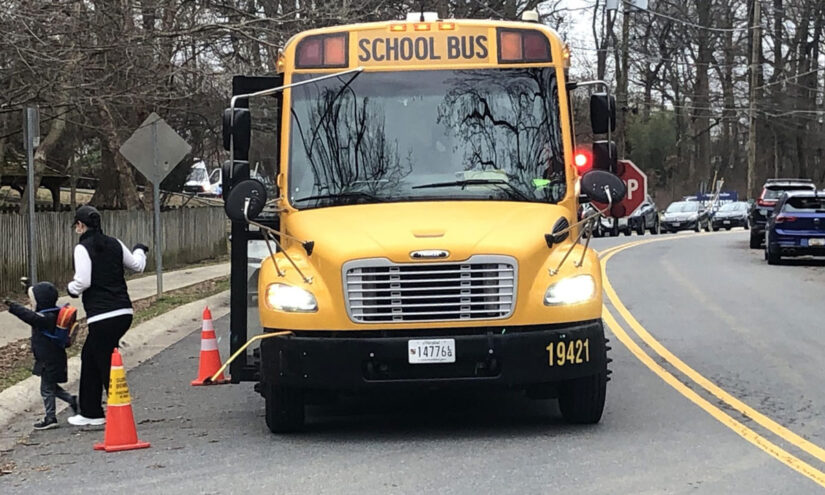

In Long Island, New York, last December, a mother witnessed her child boarding a …

US court partially upholds Biden student loan forgiveness plan

Carlos Changemaker

A U.S. appeals court has given the green light to President Joe Biden’s administration to proceed with implementing a crucial aspect of a new student debt relief initiative aimed at reducing monthly payments for millions of Americans.

Last Sunday, the Denver-based 10th U.S. Circuit Court of Appeals temporarily halted an injunction issued by a Kansas judge, responding to requests from Republican-led states who contended that the U.S. Department of Education’s debt relief program was illegal.

The three-judge panel of the 10th Circuit did not provide a rationale for granting the stay requested by the administration of the Democratic president. The Education Department did not offer any comment.

The Saving on a Valuable Education (SAVE) plan offers more favorable terms compared to previous income-based repayment plans by reducing monthly payments for eligible borrowers. It also allows those with original principal balances of $12,000 or less to have their debt forgiven after a decade.

More context:Student loan borrowers were anticipating more assistance. They find themselves in a waiting game once more.

U.S. District Judge Daniel Crabtree in Wichita, Kansas, determined on June 24 that the Higher Education Act of 1965 did not explicitly authorize the kind of “unprecedented and dramatic expansion” of income-based repayment plans envisioned.

Crabtree, ruling in favor of state attorneys general from South Carolina, Texas, and Alaska who challenged the plan, restricted the extent of his ruling to enjoin only aspects of the SAVE plan that were not already operational.

However, in a filing, the administration informed the 10th Circuit that Crabtree’s ruling was essentially “technically prospective,” and that the Education Department and loan servicers would need to reconfigure complex software to calculate new monthly payments for borrowers, generate billing notices, and manage payments.

This process would require several months, during which many borrowers enrolled in the SAVE plan would have to be placed in forbearance until their loans could be properly serviced with accurate payment calculations, argued the U.S. Department of Justice on behalf of the administration.

Last week, the Education Department announced that approximately 3 million borrowers who would have lower monthly payments under SAVE would be placed in forbearance, during which interest would not accrue.

The White House has indicated that more than 20 million borrowers could benefit from the SAVE Plan. In May, the administration noted that 8 million are already enrolled, with 4.6 million experiencing a reduction in monthly payments to $0.

While the administration requested a stay of Crabtree’s ruling, it did not ask for a similar halt to a separate injunction issued by a federal judge in Missouri that prevented further loan forgiveness for borrowers under the SAVE Plan.