During this summer, a team of students from MIT embarked on a journey to the sou …

Three Key Facts About the National Education Tax Credit Survey

Jennifer Livingstone

A recent YouGov survey revealed that as parents search for new learning options for their children, the popularity of education tax credit programs has increased.

In a poll conducted by Yes. Every Kid., a school choice advocacy group, 1,000 adults, including 200 K-12 parents, were surveyed to gauge their opinions on education tax credits. These state programs allow families to offset the cost of private school tuition by receiving refunds on their taxes.

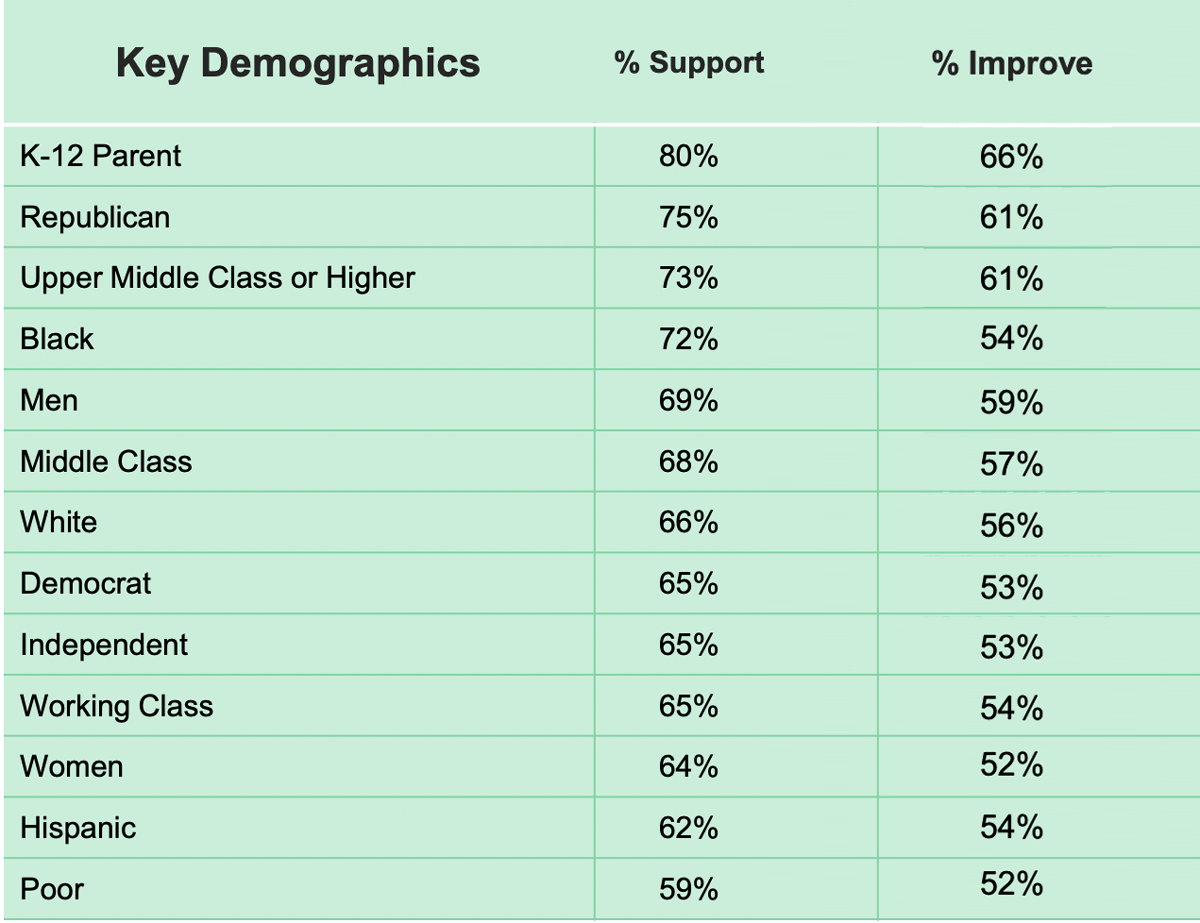

According to the survey, nearly 70 percent of adults either “strongly” or “somewhat” support education tax credits, with an even higher percentage (80 percent) of K-12 parents expressing their support. Matthew Frendewey, vice president of strategy at Yes. Every Kid., noted that the support for these programs has surged after the pandemic because parents view it as an opportunity to have more influence over their children’s education.

Despite their popularity, education tax credits remain controversial. Supporters, often Republicans, argue that these programs empower families, while opponents, often Democrats, believe that they divert state funds away from public schools and undermine the education system.

There are also other educational programs, such as education savings accounts, that have faced criticism due to how the funds have been used by parents for non-traditional educational purposes. Examples include buying kayaks, trampolines, or tickets to entertainment venues like SeaWorld.

The awareness about education tax credits increased after Oklahoma implemented the largest and most extensive program in 1987. This program reserves private school funding for families, with the cap set at $150 million in 2024, $200 million in 2025, and $250 million in 2026. Other states with similar programs include Alabama, Illinois, Iowa, Minnesota, Ohio, and South Carolina.

Lily Landry, a senior legislative analyst at Yes. Every Kid., highlighted that education tax credit programs offer families the flexibility to choose the best learning option for their children without excessive government oversight.

“There’s not as much checks and balances for families to spend their money,” Landry said. “We’re putting trust in families that know what is best for their child.”

Here are three important factors to consider about education tax credits:

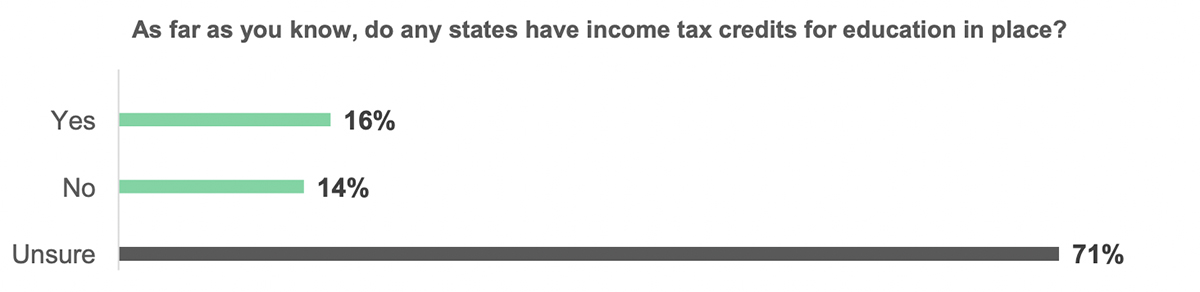

1. Limited Awareness of Education Tax Credits

Although education tax credits enjoy significant support, over 70 percent of adults surveyed were unaware if any states offer them.

Lack of awareness and communication about school choice programs contributes to this uncertainty among adults. Landry pointed out the need for clearer communication between program administrators and parents about their options. As parents become more aware of education tax credits, their approval of the program tends to increase.

2. Lower Support and Belief Among Low-Income Adults

Among poor adults, less than 60 percent support education tax credits, and around 50 percent believe that these programs would enhance the education system.

Frendewey attributed this discrepancy to the lack of exposure and information about how education tax credits work. Many middle and lower-income families may not feel that these programs benefit them or consider themselves qualifying for them. The requirement to pay out of pocket before receiving a tax refund poses challenges for families with limited financial means.

In contrast, the highest support for education tax credits comes from K-12 parents, as well as 75 percent of Republicans and 73 percent of upper-middle-class or higher income adults. Landry mentioned that higher-income households tend to be more aware of school choice options, leaving disadvantaged communities with limited information and potential utilization of these programs.

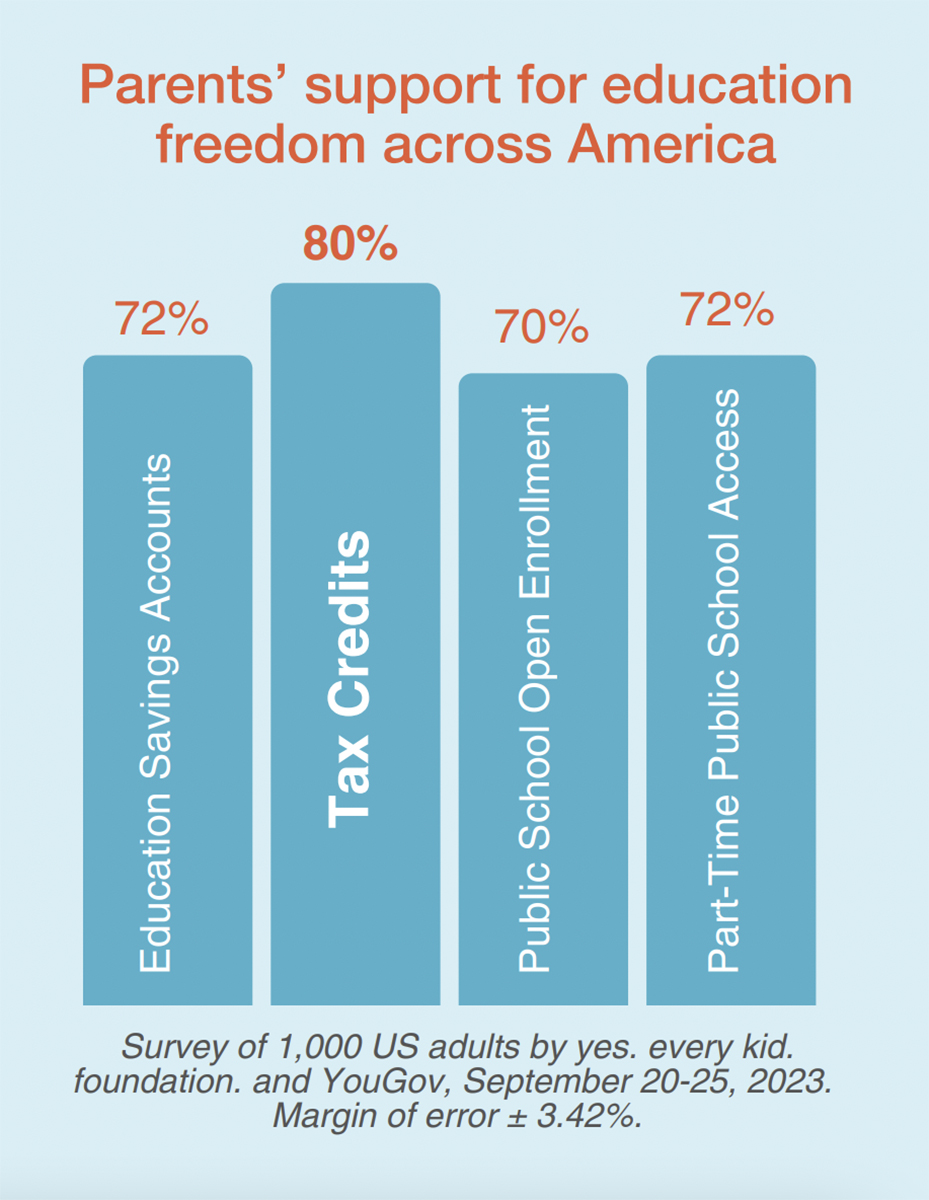

3. Support for Additional Education Measures

Among the 80 percent of K-12 parents who support education tax credits, a significant percentage also favor education savings accounts, public school open enrollment, and part-time public school access.

Frendewey highlighted that even if parents choose not to exercise choice for themselves, they value the creation of more options within the educational ecosystem. The pandemic has empowered families to explore unique ways of educating their children, highlighting the benefits of a diverse education marketplace that encompasses public schools, private schools, and homeschool co-ops.