During this summer, a team of students from MIT embarked on a journey to the sou …

Is the process of erasing student loans in bankruptcy court becoming simpler?

Emma Wordsmith

Elizabeth Hadzic and Kim Coles have ended up in bankruptcy court due to the challenges they faced in life.

Hadzic, a 50-year-old psychotherapist in Maryland, is struggling to support herself and her adult son who has incurred significant medical expenses. Coles, who is in her late 60s and works as an accountant in Oregon, was laid off last year.

Both women have accumulated tens of thousands of dollars in student loan debt. While they have been making regular payments, their financial situations have ultimately led them to pursue the option of seeking to have their loans discharged through bankruptcy court, despite the high costs and low success rates associated with this approach.

However, their experiences with the bankruptcy court have been different. Hadzic is on track to have her loans fully discharged after months of litigation. On the other hand, Coles, even though she is at retirement age, faces resistance from the government in discharging the remaining balance of her loan that she has been paying down for over a decade.

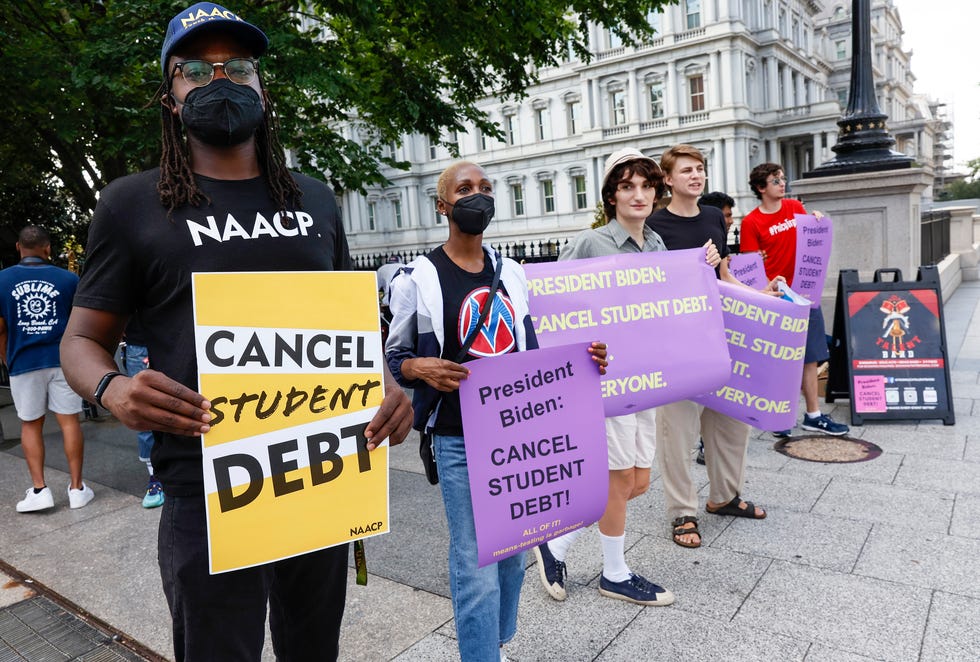

The differing treatment of their cases reflects the challenges and complexities of seeking student debt relief through bankruptcy court, as the Biden administration looks for alternative solutions following the Supreme Court’s rejection of broad student loan forgiveness.

Traditionally, only about 1 in 1,000 student loan discharges have been successful in bankruptcy court. The Justice Department implemented new guidance last year with the aim of simplifying the process and increasing the number of discharges. According to the department, around 630 cases were filed in the 10 months following the new system’s implementation, with the “vast majority” of borrowers receiving full or partial discharges.

Although improvements have been made, the system is still far from perfect. The outcome of bankruptcy cases still depends on the assigned federal lawyer and the jurisdiction in which the case is filed. Additionally, the timeline for each case varies.

While there are some who acknowledge the improvements, many believe it is too early for the administration to claim success. “I do think that it’s better than it was before,” said Dalié Jiménez, a law professor at the University of California, Irvine. “But that was a very low bar.”

Bankruptcy rarely erases student loans. Even when it does, the US government has put up a fight

Ending ‘absurd rules’

Millions of Americans go to great lengths to manage the burden of student debt, from working multiple jobs to living with their parents. Seeking relief through bankruptcy court is often seen as a last resort due to its low success rate, lengthy process, and high legal standards.

Even President Joe Biden, who previously supported laws making it tougher to discharge student debt through bankruptcy, has criticized the current system. During his presidential campaign in 2020, he promised to “end the absurd rules that make it nearly impossible to discharge student loan debt in bankruptcy.”

According to Daniel Zibel, vice president of the National Student Legal Defense Network, outcomes can still differ depending on the location of the case. The historical adversarial nature of discharge cases and the mindset of assistant U.S. attorneys have also contributed to the irregularity in outcomes. However,