During this summer, a team of students from MIT embarked on a journey to the sou …

Importance of Personal Finance Education in High Schools Highlighted in New Report

Carlos Changemaker

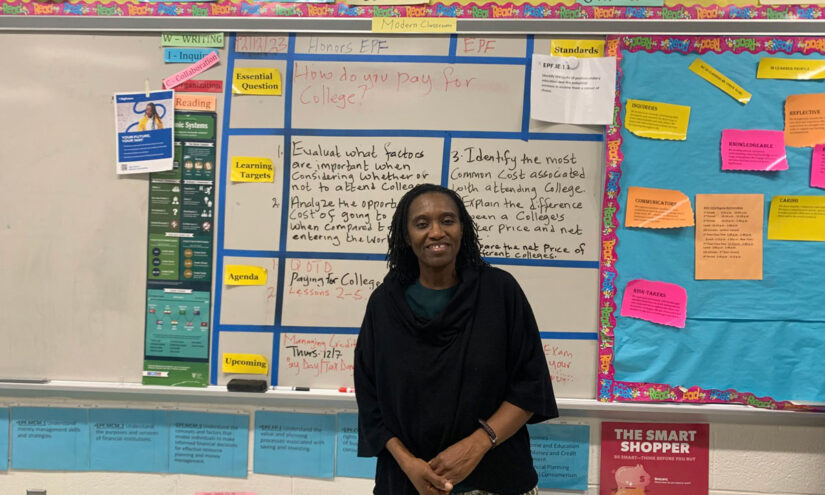

Students at Hillside High School in Shianyisimi Ogede’s economics and personal finance class were recently asked: “What is the percentage of students who receive financial aid?” The Free Application for Federal Student Aid (FAFSA) for this year has been delayed and will open in December instead of October. As a result, Ogede covers various topics related to financing education after high school with her 10th and 12th grade students.

A report card released by the Center for Financial Literacy at Champlain College in Vermont in early December graded each state based on their delivery of personal finance education in high school. The pandemic highlighted income inequality, and as a result, these courses are now being increasingly offered in schools nationwide. The report also stated that there is more concern about students learning about college loans and filling out the FAFSA.

It is mentioned in the report that high school financial instruction has several benefits, including improved credit scores, lower loan delinquency rates, and reduced use of risky services like payday lending.

The report awarded an “A” grade to seven states that ensured and implemented access to a personal finance course for students who graduated high school in the spring of 2023. The report predicts that in five years, 23 states, including North Carolina, will meet this standard. Currently, North Carolina has a “B” grade along with 41% of other states.

The increase in free online curricular courses provided by state departments of education and other organizations has helped with the preparation for these courses. The report estimates that by 2028, there will be a need for 30,000 highly trained personal finance educators in states that received an A or B grade.

In 2019, the North Carolina legislature passed a law that made financial literacy discussions a graduation requirement in schools.

During the summer of 2020, the North Carolina Council on Economic Education (NCCEE) offered virtual professional development for the new course. This 40-hour professional development included presentations from the NCCEE, NextGen Personal Finance, The Federal Reserve Bank of Richmond, and Marginal Revolution University. The training consisted of a pretest, group activities, a post-test, and access to free resources to aid in teaching the course.

Sandy Wheat, executive director of the NCCEE, stated that teachers gained more confidence about their own financial well-being after attending the training.

According to the report, students have to make more financial decisions during and after high school. However, most parents do not feel confident enough to discuss financial matters with their children at home, leaving schools responsible for financial education.

This report also highlighted the disparities in financial capability among different groups in the United States. Schools with higher percentages of students of color are less likely to have access to required personal finance courses or content.

In addition to covering topics like student loans and financial aid, Ogede’s students also learn about the importance of investing and managing credit. They even collaborate with Duke University students through the First Generation Investors program, where they decide how to allocate $100 among stocks, bonds, and companies they are personally interested in. At the end of the course, the $100 is transferred to their names.

According to Ogede, in America, wealth is linked to credit scores. This means that having a poor credit score can result in higher interest rates. Ogede noted that this knowledge may not be passed down to the Brown and Black population who did not grow up in an environment where investing and financial literacy were common.

Wheat mentioned that the financial landscape has become more complex, which raises concerns for students.

Wheat believes that offering a personal finance course allows teachers to address the specific needs of their communities.

In terms of feedback, Wheat stated that teachers who went through the NCCEE training had positive experiences. Students no longer question how they will apply what they learn in real life.

To find out more about the financial literacy requirements in North Carolina, you can read the education standards here.